Rodney Dangerfield once told a joke about borrowing money from a loan shark.

He said he borrowed a hundred dollars, paid back $20 a week for three years and still owed $250.

Sounds like trying to repay a student loan.

My son Virgile, who never had student loans to repay, told me a few years back that friends of his from college were still repaying their college loans 12-13 years after graduation. In other words, young people in their mid thirties were still saddled with debt from getting their degrees.

And Republicans wonder with these same people aren’t participating in the consumer economy, running up debts to buy new cars, bigger televisions and the newest models of smartphones.

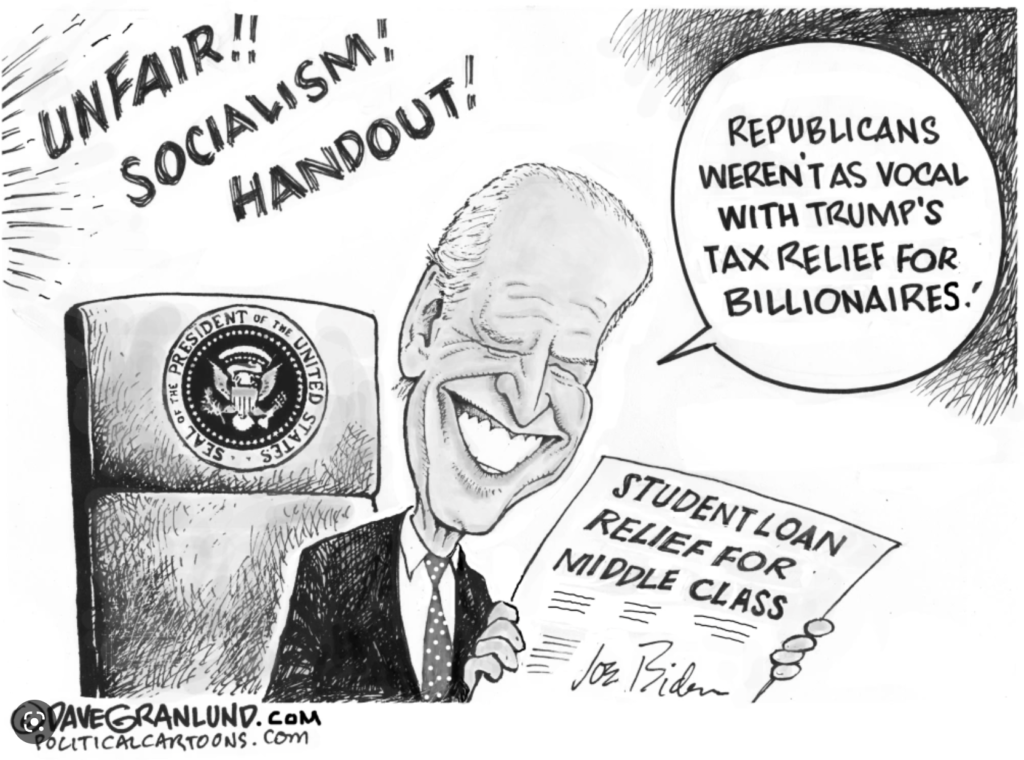

And of course they’re attacking President Biden for his plan to forgive a good-sized chunk of student loan debt, saying all he is doing is shifting the burden from borrowers to taxpayers.

Yet any time the megarich have bad investments or bank failures, they don’t want those unfortunate people to suffer. When Silicon Valley Ban went under, they said depositors would be made whole above and beyond the $250,000 FDIC limit.

As Mel Brooks once said, it’s good to be the king(s).

Sadly, so many well-intentioned things are mixed blessings. Student loan programs made it easier for millions of people to get college educations, but they also caused a ridiculous amount of inflation in college costs. When I graduated from high school in 1967, a year of tuition at an Ivy League school was only about $3,000.

When my two children graduated from high school in 1998 and 2003, their yearly expenses at public universities in California cost us about $15,000 each.

Sound bad? It gets worse.

My two nephews recently attended outstanding private schools in the east for which total annual expenses (before deducting for financial aid) were about $65,000 each.

Someone is making out like bandits here, and it isn’t the working class.

Republican attacks on Biden claim he’s making people who either didn’t have loans or who already repaid theirs pay for these profligate borrowers. It reminds me of a cartoon I once saw where three people were sitting at a table. One was a typical taxpayer, one a union member and the other a plutocrat.

There were 10 cookies on the table. The plutocrat had nine of them and he told the taxpayer to watch out, that the union member was trying to steal part of his cookie.

I have written many times over the years that America is cursed by having the greediest, stupidest and most shortsighted rich people in the world. Their basic philosophy has always been what’s theirs is theirs and what’s ours is negotiable.

Their minions on the GOP side of the aisle in Congress are doing their bidding, demanding that before they will vote to increase the debt limit, Biden must abandon his student loan relief program. Meanwhile, at least one generation of college graduates is falling so far behind economically that they will never catch up.

Understanding that Republicans will never abandon their benefactors, I think there might be a reasonable compromise that while it wouldn’t solve the problem, it might at least ameliorate it.

There are two things that might be done.

The best would be forgiving interest payments and only requiring payment on the principal. If someone had $50,000 in student loans to start and had already made total payments of $30,000 (which would include interest), then they would only owe $20,000 and would not pay any interest on that.

That’s reasonable to me, but if we can’t even get the GOP to go for that, here’s a lesser version of interest forgiveness. If someone had $50,000 in student loans and still had a balance due of $30,000, then that $30,000 would be all they would pay. No future interest.

Simply forgiving interest — past or future — would not solve the problem, but it would make the light at the end of the tunnel a little brighter.

And that would be a good thing that wouldn’t even hurt the plutocrats all that much.