“It’s alright, it’s alright, it’s alright. You can’t be forever blessed.”

Perhaps the day will come when I stop using Paul Simon’s “American Tune” as a jumping-off point to write about problems in our country, but that time hasn’t come yet. A song that resonated when Richard Nixon was Watergating us was still meaningful when Donald Trump was gaslighting us.

Do you know anyone other than politicians who say America’s best days are still ahead?

I sure don’t. I can’t think of one metric that’s heading in the right direction for us as a nation.

We’re getting less healthy in general and more obese individually. We learn less and read less. We’re less social than we used to be, going from civic organizations and bowling leagues to Internet groups ridiculously called “social media.”

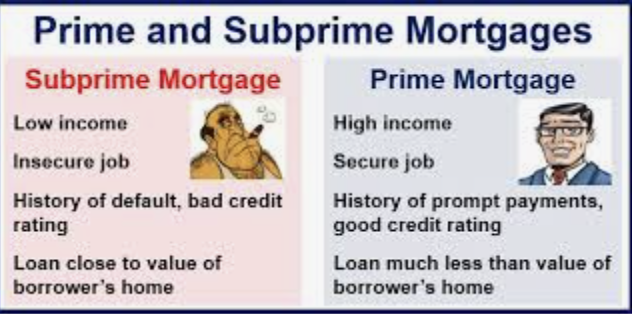

But there are also problems that really can’t be fixed without massive systemic changes. In 1965, the top 1 percent of income earners made 7 percent of the income. That’s a reasonable division of wealth for a free society, where people with more talent who work hard have more opportunities than people who don’t.

Things like the progressive income tax basically kept the rich from overwhelming the working class. But starting with the Reagan years, the rich worked hard to get government regulation reduced and income tax rates lowered.

I’ve written about tax rates before, but in mid 2020, the top 1 percent’s share of the income had reached 20 percent. There are so many billionaires now that it’s difficult to imagine how we will ever find a way to reduce income diversity very much.

Do you have any idea how many Americans have negative wealth? If we define negative wealth as owing more than they own, it’s a pretty horrific figure. At the end of 2017, the Institute for Policy Studies reported that 20 percent of American households owned less than they owed.

Break it down further and 30 percent of African-American households and 27 percent of Latino households are in that same leaky boat.

Figures at that time said Americans had more than $1 trillion in credit-card debt and $1.4 trillion in unpaid student loans.

Throw in car loans and homes mortgaged to the hilt and you have an unworkable society.

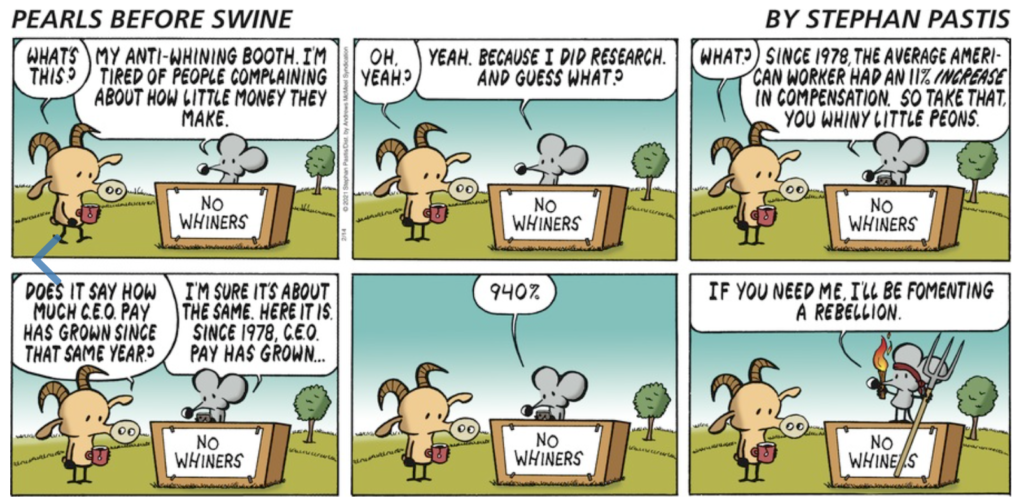

During the crash of 2008, when an overheated mortgage market went completely to hell, people were shocked to learn that some of the biggest mortgage brokers were steering people into subprime mortgages when those people actually were qualified for prime mortgages.

Many of the people were first-time buyers and were thrilled to be hold they qualified for any kind of loan at all. When they were later told they had been cheated, the reaction was fairly common.

“Why would they want to do that to us? Why did they want to hurt us?”

I’m sure you know the answer to that one without me telling you. After all, some people actually realize that when Gordon Gekko said “Greed is good,” he was speaking as the bad guy in “Wall Street.”

It would be fascinating to know what percentage of Americans make a living by hurting other people. Other than boxers, of course. Because no matter what they tell you, the answer to poverty isn’t just baking a bigger pie. If your wealth is $100,000 and you get a 10 percent break, you’ve made $10,000 dollars. If Jeff Bezos gets the same break, he gains $10 billion. And if both of you are bidding on something you want, his 10 percent goes a lot further than yours.

You can’t get around that in a society like ours.

There are a few things I can think of that might help, some sensible and some more goofy.

First, every kid who goes to school must pass a class in civics and personal responsibility. The civics part wouldn’t just be about government, but about how society should work at the local, state and federal levels. It would cover what it takes to be a good citizen, but also what your rights as a citizen are and what a sense of community is. The personal responsibility part would explain why saving money matters, how credit cards can kill you financially when overused or misused and other things that would make people at least a little more savvy.

Second, we need to get the money out of politics. Make it plain that money is not free speech and greatly restrict corporate lobbying. Battling for tax breaks for an industry isn’t the same as battling on the abortion issue. Elected officials would be banned for life from working as lobbyists after they leave office. Restricting corporate lobbying is the only way to get to term limits, which I am beginning to see some use for.

Third, and here is where we get into the goofy area, I would declare a jubilee on credit card debt and student loan debt for all those making less than $50,000 a year and those who have negative wealth levels. There would be one condition attached. Anyone accepting the bailout would never again be allowed to have credit cards or student loans. Before you tell me how ridiculous that is, let me say I understand this could cause economic chaos for a while. I think the benefits are worth it.

Fourth, executive compensation of more than $1.5 million a year (all benefits, not just wages) could not be deducted as a business expense by the company paying it. If you’re wondering why that specific number, it is derived by taking a minimum wage of $15 an hour and saying a CEO should not make more than 50 times the pay of his lowest employees. Please note that companies can still pay executives more. They just can’t deduct the excess.

There’s a lot more to be said, but this would be a good start.

Our best days may not be ahead of us, but that doesn’t mean things have to get worse and worse.

It’s up to us.